What you Need to Know about Section 179 for Small Business Owners

As a small business owner, it’s important to take advantage of any tax deductions that can help reduce your tax liability. One such deduction is Section 179 Depreciation. This allows you to deduct the full cost of qualifying equipment purchased or financed during the current tax year. Here is how buying from Visual can help you take advantage of the deduction.

How Section 179 Works

Section 179 is an IRS tax codes allowing a business to deduct the full cost* of qualifying equipment acquired (and put into use) during that same tax year, rather than using standard depreciation to write off smaller amounts over several years. In 2025, a business can deduct the full purchase price of qualifying equipment up to $2,500,000. There are restrictions that may prevent some businesses from taking Section 179 (e.g. large companies or companies with tax losses).

Qualifications

Equipment, machines, vehicles, computers and software, and office furniture for business use could all qualify. Certain types of improvements to your office building may even qualify!

Did you know you can finance equipment AND use Section 179?

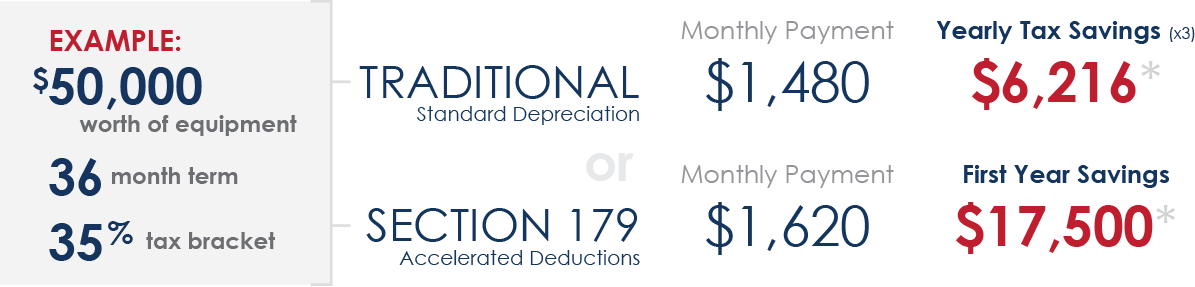

By combining financing with Section 179, you can protect your cash flow AND reduce your tax impact! When you finance as asset, you’re making smaller payments over time versus paying the full purchase price upfront…leaving you more cash on hand for other expenses. Come tax time, if you used a Capital Lease (Conditional Sale) structure, you may be able to deduct the full purchase price in the first year…the same way you could if you paid cash, but without the large initial investment!

Restrictions

Here are a few of the key limitations:

- The amount deducted via Section 179 cannot exceed a total of $2,500,000 for this tax year.

- You cannot use Section 179 deductions to show a loss on your income statement.

- To qualify for Section 179, an asset must be dedicated to at least 50% business use.

- Section 179 is phased out when total equipment purchases during the year exceed $4,000,000.

Equipment or assets must be installed and put into use on or before December 31, 2025 to qualify for a deduction this year. Factors like inventory and long lead times make it necessary to start thinking about making your capital equipment purchases and planning for Section 179 deductions now!

Contact us or your sales rep today and let us help you save money on your 2025 taxes!